Lecture 4: Goods Market and Financial Market

Mingze Huang

2021-08-05

The Composition of GDP (Y)

GDP Decomposition by BLS

Consumption (C): goods and services purchased by consumers.

Investment (I):

Net Exports (Trade Balance) = Exports (X) - Imports (IM): exports exceed imports is said to run a trade surplus; exports less than imports is said to run a trade deficit.

Exports: the purchases of domestic goods and services by foreigners.

Imports: the purchases of foreign goods and services by domestic consumers, domestic firms and government.

Demand (Income Side)

Demand (income side) always comes from consumption (C), investment (I), government spending (G) and net exports (X - IM).

- Recall wage and profit in the example of GDP aggregation (income side).

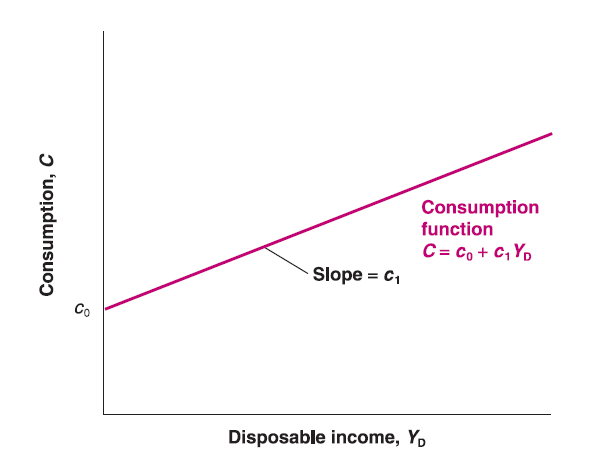

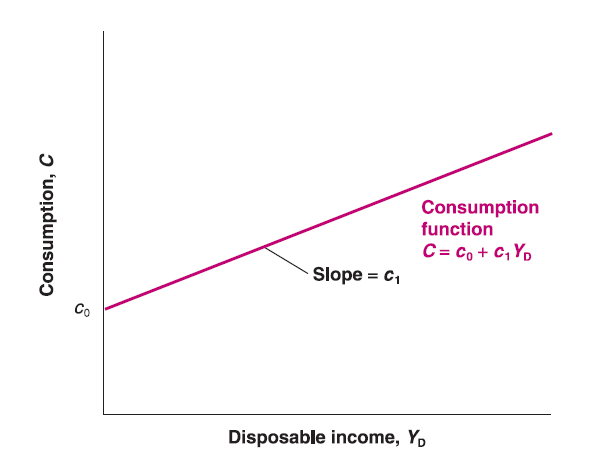

The main factor determines consumption (C) is disposable income (\(Y_{D}\)), the income remains after consumers have received transfers from government and paid taxes.

Demand (Income Side)

Net Taxes (\(T\)): taxes minus government transfer payments. Advanced Child Tax Credit and Stimulus Check

Disposable income equals to total income (GDP) deduct net taxes: \(Y_{D}\equiv Y-T\).

Therefore, \(C=c_{0}+c_{1}(Y-T)\). Stimulus Check and Consumption

- Higher income \(Y\), higher consumption \(C\); Higher net taxes \(T\), lower consumption \(C\).

Equilibrium

Here the model assume investment is given (exogenous) \(I=\overline{I}\).

Government choose government spending \(G\) and net taxes \(T\) by fiscal policy.

Note that GDP (\(Y\)) also represents production.

Here we’re discussing goods market equilibrium, which is the balance between quantity of supply and quantity of demand. Obviously the GDP here is real GDP: \(Y=Y^{r}\); \(Y_{D}=Y_{D}^{r}\).

Since production side equal to income side in equilibrium, if we assume zero trade balance (\(X - IM = 0\)), then\(Y^{r} = C+\overline{I}+G\) or \(Y^{r} = c_{0}+c_{1}(Y^{r}-T)+\overline{I}+G\).

- In equilibrium, production, \(Y^{r}\) (the left side of the equation), is equal to demand (the right side). Demand in turn depends on income, \(Y^{r}\), which is itself equal to production. GDP represents both production and income. Production and income are always equal!

Investment equal to Saving

Alternatively, we can look at saving.

Private saving (S): saving by consumers, is equal to disposable income minus consumption: \(S=Y_{D}^{r}-C\) or \(S=(Y^{r}-T)-C\).

Public saving: saving by government is equal to net taxes minus government spending: \(T-G\). Taxes exceeds government spending (public saving is positive), is said to run a budget surplus; taxes less than government spending (public saving is negative), is said to run a budget deficit. Federal budget deficit by CBO

Assume zero trade balance, \(Y^{r} = C+\overline{I}+G\).

Rearrange the equation: \((Y^{r}-T)-C+(T-G)=\overline{I}\).

Private saving \((Y^{r}-T)-C\) plus public saving \(T-G\) equal to investment.

In equilibrium, investment always equal to saving: \(\overline{I}=S+(T-G)\). This is so called IS relation.

In summary, the equilibrium condition for goods market:

Production == demand

investment == saving

The demand for money

This model assume you only have choice between two assets, money and bonds:

Money, which you can use for transactions, pays no interest. In the real world, there are two types of money: currency, and deposit accounts.

Bonds pay a positive interest rate, \(i\), but they cannot be used for transactions. In the real world, there are many types of bonds, each associated with a specific interest rate. US Treasury Bond

Note that the main reason to assume these two assets is to characterize the trade-off between interest and liquidity. There are different financial assets with liquidity and interest between those two cases.

You should hold both money and bonds. The proportion depend on two variables: