Monetary Policy in Medium Run on AS-AD Model (Monetary Expansion)

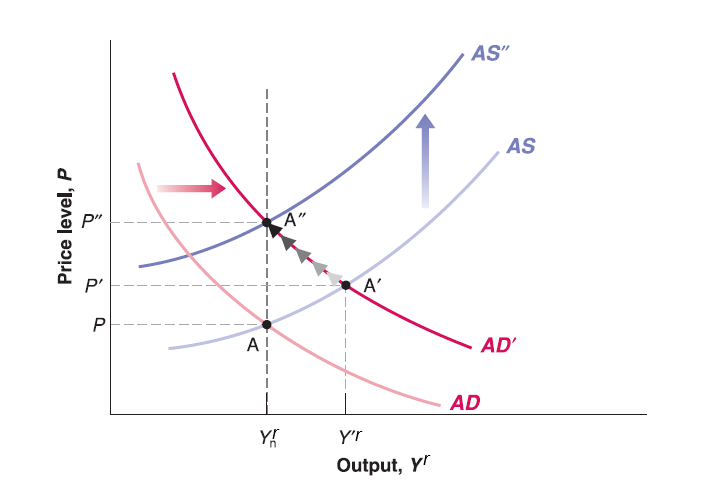

Assume the economy starts on medium run equilibrium (labor market equilibrium, goods market equilibrium and financial market equilibrium hold simultaneously, expected price level equals to current price level and keep unchanged (\(P^{e}=P\)), Output level on natural output level (\(Y_{n}^{r}\)):

Now central bank implements monetary expansion policy (increase of money supply).

In short run, this will push AD curve to right, goods market and financial market equilibrium deviate labor market equilibrium. Price level goes higher than expected price level (\(P'>P=P^{e}\)), output level higher than natural output level (\(Y'^{r}>Y_{n}^{r}\)).

In medium run, workers will upwardly update expected price level (\(P^{e}\)), this will shift AS curve up. Until the output goes back to natural output level (\(Y_{n}^{r}\)) and expected price level equal to current price level again. So that labor market equilibrium restores. The economy reaches new medium run equilibrium but equilibrium price level hikes.

Question: How if central bank implements monetary contraction policy (reduces money supply)?

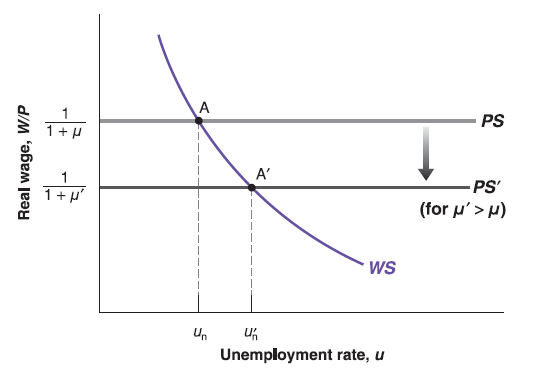

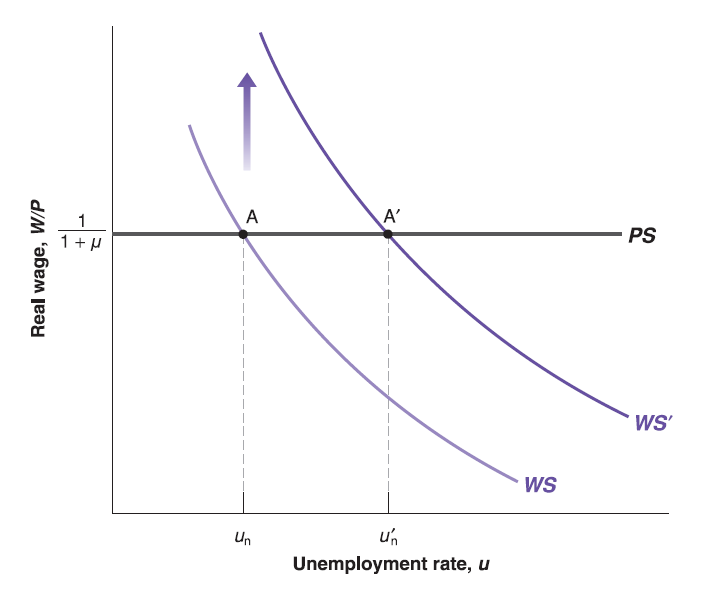

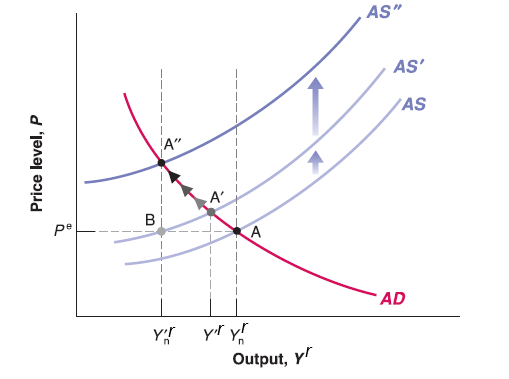

Effects on Natural Rate of Unemployment on AS-AD Model

Price level \(P\) goes higher than expected price level \(P^{e}\), output level \(Y'^{r}\) higher than new natural output level \(Y'^{r}_{n}\).

workers will update their expectation until output level reaches new natural output level \(Y'^{r}_{n}\) in medium run. In new medium run equilibrium, natural output level reduces from \(Y_{n}^{r}\) to \(Y'^{r}_{n}\). Price goes up a lot.

Unlike short run effect of fiscal policy and monetary policy (demand side change) on Aggregate Demand (AS) curve, the structural change in labor market will change equilibrium in medium run!

The effect of supply shock will be more persistent than demand shock! Policy makers have to go back to market structure in Microeconomics